mailforum.ru

Tools

How Much Should I Have Saved For Retirement By 30

The short answer is that you should aim to save at least 15 percent of your income for retirement and start as soon as you can. But there's more to the. Graphic titled, “How much could $1 million or more give you per year? * The accumulated investment savings by age 65 could provide an annual retirement income. By age 30, you should have one time your annual salary saved. For example, if you're earning $50,, you should have $50, banked for retirement. By age Many financial professionals recommend saving 10% to 15% of your total income. Yet how much you should save largely depends on your retirement goals, age, and. The standard advice for average retirement savings is to try to have your annual salary saved up by age 30, and to basically add that amount again to your. Create a budget. Do you know where your money is going? · Pay yourself first · Save often · Save early · Enroll in your company's retirement plan (if you haven't. By age 30, you should have saved about $52,, assuming you're earning a relatively average salary. This target number is based on the rule of thumb you should. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. That means that a year-old making $45, a year should have up to $, (three times their income) saved in their retirement accounts—which is more than. The short answer is that you should aim to save at least 15 percent of your income for retirement and start as soon as you can. But there's more to the. Graphic titled, “How much could $1 million or more give you per year? * The accumulated investment savings by age 65 could provide an annual retirement income. By age 30, you should have one time your annual salary saved. For example, if you're earning $50,, you should have $50, banked for retirement. By age Many financial professionals recommend saving 10% to 15% of your total income. Yet how much you should save largely depends on your retirement goals, age, and. The standard advice for average retirement savings is to try to have your annual salary saved up by age 30, and to basically add that amount again to your. Create a budget. Do you know where your money is going? · Pay yourself first · Save often · Save early · Enroll in your company's retirement plan (if you haven't. By age 30, you should have saved about $52,, assuming you're earning a relatively average salary. This target number is based on the rule of thumb you should. When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. That means that a year-old making $45, a year should have up to $, (three times their income) saved in their retirement accounts—which is more than.

Experts recommend you aim to save 15% of your pretax income for retirement if you start saving at age If you start saving at age 30, it's 18%. Make sure you. You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If you save 5% of. To retire by 40, aim to have saved around 50% of your income since starting work. Aim to save 20% of your take-home pay each month. · For retirement savings, aim to save 10% to 15% of your pre-tax income each year. · When you create a budget. A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age Your 30s can be a great time to build up your emergency savings alongside saving for retirement. Empower research shows that 60% of Millennials (many of whom. Based on Fidelity's rule of thumb, you should have at least your annual salary saved by age 30 and two times by age The reality is that your. How much money you should have saved by 30? If you're 30 and wondering how much you should have saved, experts say this is the age where you should have the. As you reach your 40s and 50s, saving for retirement will become one of your most important goals. As a general rule of thumb, you'll want to have saved three. The final 20% of your income should to towards savings, retirement and paying off debt. Some experts explain it another way and recommend that your savings. Someone between the ages of 26 and 30 should have times their current salary saved for retirement. Someone between the ages of 31 and 35 should have For example, if you are 29, making $,, you would want a savings of $35, - $90, to maintain your current lifestyle. (The higher and lower ends of the. Your 30s can be a good time to aggressively pay down any non-mortgage debt. If you still have high-interest debt, you may be earning 8% in your retirement. Enjoying Retirement and Wanting Income · Savings Total: In general, the goal is to have enough saved for 20 to 30 years in retirement. A general guideline is to. The median savings is $5, If you're in your 30s, you may have some advantages that could help you to grow your savings. For. At age 30, some financial professionals suggest accumulating the equivalent of your current annual income. By age 40, you should have accumulated three times. Based on Fidelity's rule of thumb, you should have at least your annual salary saved by age 30 and two times by age The reality is that your. Why You Should Open a Personal Retirement Savings Account Now Financial experts say you'll need 70 to 80 percent of your pre-retirement income to maintain. Verrrrrry roughly, you'd want 4–5 times your yearly expenses saved up by then. That'd put you on a track to have about 20–25x your yearly. Saving 1x your income by age 30 is recommended to harness the power of compound interest and prepare for a comfortable retirement. Start saving early, even.

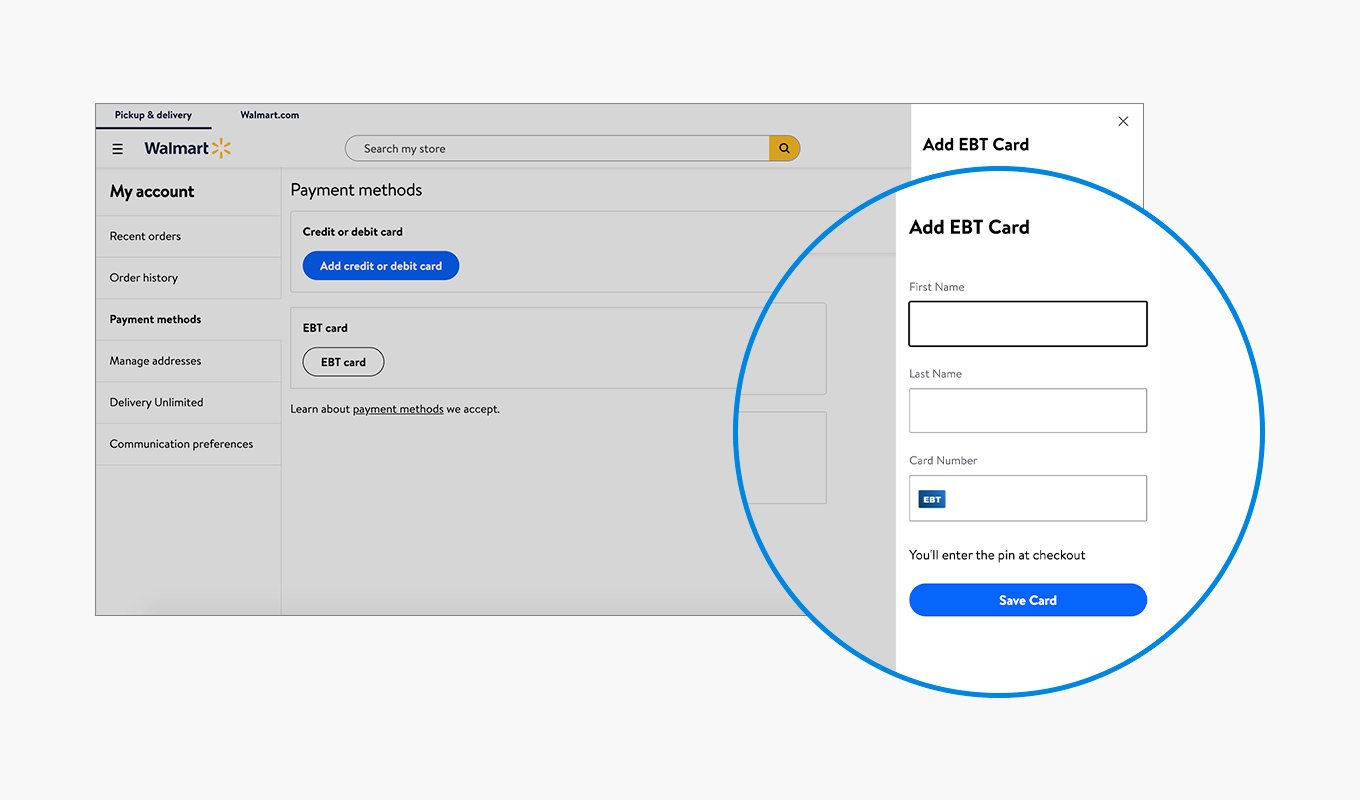

Can I Pay Walmart Online With Ebt

3) Swipe EBT card with the Walmart associate upon arrival at the pick-up How can SNAP participants pay for online delivery? SNAP benefits can't be. Which stores accept EBT SNAP as a form of payment through Instacart? EBT SNAP-eligible Instacart customers in the U.S. can pay for online grocery orders. EBT has never worked with Walmart Pay at the registers. It only works for online pickup or delivery orders. You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Reasor's, Cash Saver, Homeland Food Stores, United. EBT has never worked with Walmart Pay at the registers. It only works for online pickup or delivery orders. Georgians can now shop online with SNAP. August 05, Share. About | Contact | Statements · JWT Auth for open source projects. Walmart accepts several payment methods such as the following: EBT cards from participating states for the purchase of EBT eligible items; Debit cards. CAN SNAP PARTICIPANTS USE BENEFITS TO. PAY FOR SHIPPING OR DELIVERY? HOW WILL I KNOW IF THESE RETAILERS CAN. DELIVER TO MY HOME? Amazon. Walmart. ShopRite. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. 3) Swipe EBT card with the Walmart associate upon arrival at the pick-up How can SNAP participants pay for online delivery? SNAP benefits can't be. Which stores accept EBT SNAP as a form of payment through Instacart? EBT SNAP-eligible Instacart customers in the U.S. can pay for online grocery orders. EBT has never worked with Walmart Pay at the registers. It only works for online pickup or delivery orders. You can order groceries online for curbside pick-up or delivery using SNAP through Amazon, Walmart, ALDI, Reasor's, Cash Saver, Homeland Food Stores, United. EBT has never worked with Walmart Pay at the registers. It only works for online pickup or delivery orders. Georgians can now shop online with SNAP. August 05, Share. About | Contact | Statements · JWT Auth for open source projects. Walmart accepts several payment methods such as the following: EBT cards from participating states for the purchase of EBT eligible items; Debit cards. CAN SNAP PARTICIPANTS USE BENEFITS TO. PAY FOR SHIPPING OR DELIVERY? HOW WILL I KNOW IF THESE RETAILERS CAN. DELIVER TO MY HOME? Amazon. Walmart. ShopRite. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana.

Can I use my SNAP benefits to buy groceries online at any store that offers online shopping? No, not all FNS approved retailers are authorized to accept EBT online. The only retailers currently authorized are Amazon and Walmart. How will I know if these. Only items shipped & sold by mailforum.ru are eligible to be paid with SNAP. Marketplace items are not eligible for SNAP benefits. How do I check my SNAP EBT/EBT. Online grocery shopping and delivery at mailforum.ru Buy EBT eligible items on dairy, bread, meat, vegetables, candy, cereal, and frozen food. Save money. Here, you can't make an online EBT card order at Walmart without paying for it FIRST. When you place the order, Walmart immediately puts a hold. This is called "online purchasing" or "SNAP online." Several major retailers, including Amazon, Walmart, and Target, accept SNAP EBT cards for. *SNAP / EBT can only be used for club purchases. Pickup orders are online purchases and cannot be paid for using SNAP. can be used at Walmart or Sam's. Massachusetts residents who receive SNAP benefits can use their EBT card to buy food online Walmart, as well as ALDI, Big Y, Brothers Marketplace. Additionally, EBT cardholders are able to use their benefit cards for online purchasing at Safeway, Amazon, Walmart, and more. For additional information. Q: Can I connect with debit/credit/EBT or gift card? A: Yes, visit the Walmart Help Center to see all available Payment Methods. Q: I tried to submit a paper. Sign into your Walmart pickup & delivery account. If you don't have one create an account. • Select Payment Methods. • If your local store accepts EBT Online. Which online retailers accept SNAP EBT payments? Amazon and participating ShopRite and Walmart stores currently accept online EBT payments in. Delaware. In Mississippi, groceries can be purchased online through Walmart and Amazon using a SNAP EBT card. Shopping online is an easy and convenient way to shop for. SNAP benefits cannot be used to pay for delivery fees. Curbside pickup is available at Walmart to avoid a delivery fee. Amazon is currently offering free. Go to check out - Enter your SNAP EBT card for payment options. SNAP EBT will only cover SNAP-eligible items. Non-eligible items, delivery, and processing fees. Can I use my EBT card to cover the delivery fee? No. SNAP benefits cannot be used to cover the delivery fee at Walmart. You must pay for fees with another form. Walmart is one of many retailers that accepts EBT payments (in 48 states you can pay at checkout, in Alaska and Montana, you can pay at pickup) and a convenient. Using your EBT on Target Online · When you arrive at checkout, you will be able to edit the amount applied to the SNAP EBT payment if needed prior to selecting. If you get CalWORKs, you can use your cash benefit to pay for delivery at Walmart. 8. Can I use my EBT card to buy non-food items? If you only get CalFresh food. Neither SNAP or cash benefits can be used to pay for fees of any type, such as delivery, service, or convenience fees. Online EBT will remain a permanent option.

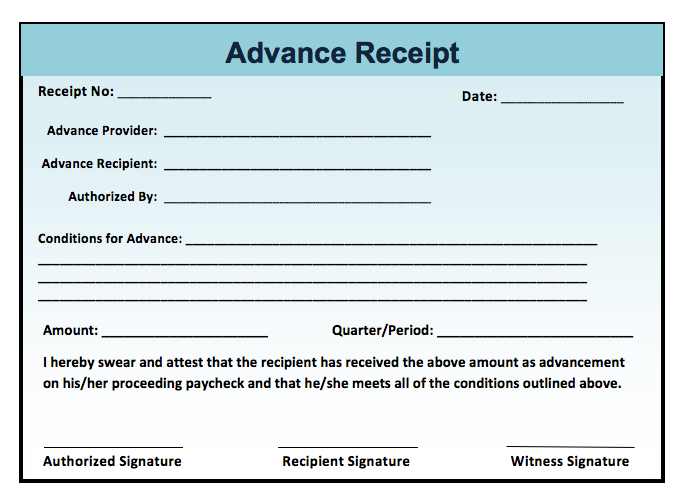

Invoice Advance Loan

Although lenders typically don't advance the full value of your outstanding invoices, they generally finance a large percentage of their value, often as high as. Get a cash advance of up to 90% with selective invoice financing. Access fast working capital on a pay-as-you-go basis. What Is Invoice Financing? Invoice financing is a type of business loan that's made based on the value of your outstanding invoices. · Invoice Financing. The funding process when selling invoices is about as fast as a merchant cash advance Compare Invoice Funding Options to Find the Best Loan For Your Business. Specifically, invoice financing, also called accounts receivable financing, refers to an invoice-based cash advance. This form of near-term financing lets a. Invoice finance lets you use your unpaid invoices as security for funding. So, instead of waiting weeks or months to get paid, you can secure a percentage of. Invoice financing is one of the most popular small business loans it allows you to receive advance capital for your unpaid invoices! invoices to advance and when to advance them. Industry Familiarity. Finally loans, invoice financing is usually faster than invoice factoring. With. Also called accounts receivable financing, invoice financing is when a company gets a cash advance from a financial institution (e.g. bank) based on unpaid. Although lenders typically don't advance the full value of your outstanding invoices, they generally finance a large percentage of their value, often as high as. Get a cash advance of up to 90% with selective invoice financing. Access fast working capital on a pay-as-you-go basis. What Is Invoice Financing? Invoice financing is a type of business loan that's made based on the value of your outstanding invoices. · Invoice Financing. The funding process when selling invoices is about as fast as a merchant cash advance Compare Invoice Funding Options to Find the Best Loan For Your Business. Specifically, invoice financing, also called accounts receivable financing, refers to an invoice-based cash advance. This form of near-term financing lets a. Invoice finance lets you use your unpaid invoices as security for funding. So, instead of waiting weeks or months to get paid, you can secure a percentage of. Invoice financing is one of the most popular small business loans it allows you to receive advance capital for your unpaid invoices! invoices to advance and when to advance them. Industry Familiarity. Finally loans, invoice financing is usually faster than invoice factoring. With. Also called accounts receivable financing, invoice financing is when a company gets a cash advance from a financial institution (e.g. bank) based on unpaid.

The process of spot factoring is the same as a regular factoring contract. The factoring company will verify the invoice and advance the business a percentage. Also known as invoice financing, invoice factoring provides an advance on payments for outstanding invoices. Learn more about what Headway Capital offers to. Turn unpaid invoices into working capital. Don't wait on net terms. Get a cash advance on your outstanding invoices with invoice factoring via FundThrough. Opportunity Business Loans offers the most convenient and affordable invoice financing options for small- and mid-sized businesses in a variety of different. Invoice factoring helps small businesses by converting invoices to immediate cash advances. payments to the funder until the entire advance amount is. I've been diving into the concept of invoice financing, a solution that allows businesses to obtain advances on outstanding invoices. Invoice advance loans are a type of financing that allows businesses to access cash quickly by selling their outstanding invoices to lenders at a discounted. Your accounts receivable act as collateral, which means you can get an advance fast. Invoice financing companies, a boon for entities seeking alternatives to. Often, companies compare business cash advances against other products, such as factoring and purchase order financing, to determine which offers the best. An Invoice Advance Loan is a financing tool where businesses, including freelancers, borrow money against unpaid invoices. It enables immediate cash flow. Invoice financing is a way for businesses to borrow money against the amounts due from customers. Invoice financing helps businesses improve cash flow, pay. The factor then advances a lump sum up to 95% of the value of the invoice to the business owner. As you make sales, the invoice factoring company will collect. Each invoice advance and each cash draw is a separate, closed-end term loan that has its own loan amount, interest rate, and payment terms. Cash draw feature. Invoice financing options advance the cash you need so you can say goodbye to cash flow worries. Whether you are a small startup or an established enterprise. To complement the invoice finance definition, know that invoice financing advance as soon as an invoice is raised. Cash flow: it helps you secure your. Invoice factoring lets you sell your company's outstanding invoices at a discount to a third party (known as a “factoring company” or “factor”). When you sell. You may be familiar with invoice factoring products on offer from other business finance providers. With Prospa, our products advance your business % of. Get all this with invoice financing from SBG Funding · Rates starting at %*/week · Quick and easy application process · Decisions within 24 hours · Funding. Invoice factoring is a financing solution that allows small business owners to turn unpaid invoices into cash for short-term working capital. Small business. Under this arrangement, businesses are offered funds in advance against individual invoices. Adjustments to the funds disbursed are made daily. Under.

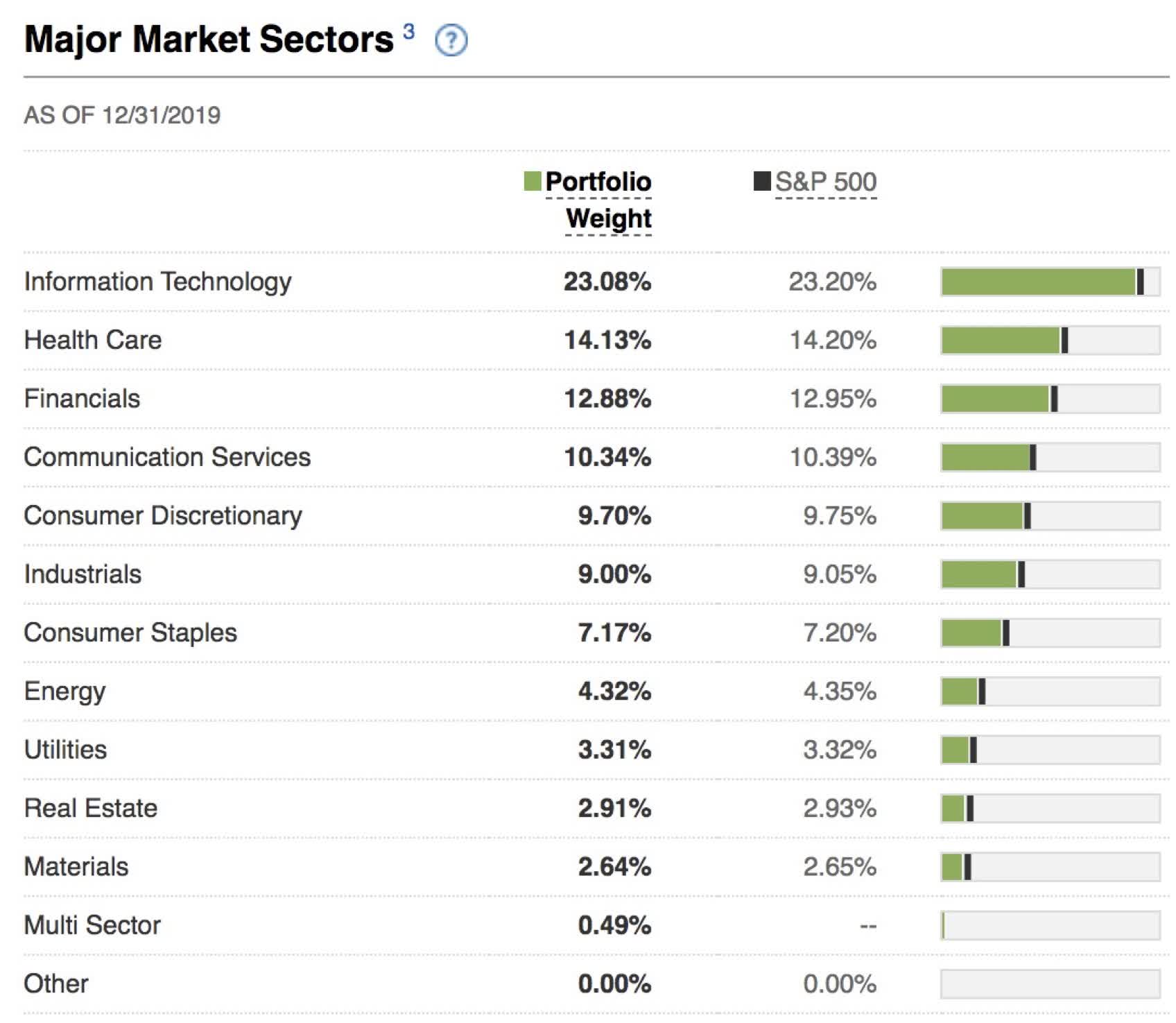

Fidelity Small Value Index Fund

About FISVX. The investment seeks to provide investment results that correspond to the total return of stocks of small-capitalization U.S. companies. FISVX: Fidelity Small Cap Value Index Fund - Class Information. Get the lastest Class Information for Fidelity Small Cap Value Index Fund from Zacks. Fidelity Advisor Mutual Funds · Fidelity Mutual Funds · Fidelity ETFs · Fidelity Money Market Funds · Model Portfolios · Separately Managed Accounts · The investment seeks capital appreciation. The fund invests primarily in common stocks. It invests at least 80% of assets in securities of companies with small. Fidelity Small Cap Value Index Fund (FISVX) Dividend Info. Fidelity Small Cap Value Index Fund (FISVX) dividend growth in the last 12 months is %. Performance charts for Fidelity Small Cap Value Index Fund (FISVX) including intraday, historical and comparison charts, technical analysis and trend lines. The Fund seeks to provide investment results that correspond to the total return of stocks of small-capitalization U.S. companies. It invests in securities. Get Fidelity Small Cap Value Index Fund (FISVX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Objective. The fund seeks to provide investment results that correspond to the total return of stocks of small-capitalization United States companies. · Strategy. About FISVX. The investment seeks to provide investment results that correspond to the total return of stocks of small-capitalization U.S. companies. FISVX: Fidelity Small Cap Value Index Fund - Class Information. Get the lastest Class Information for Fidelity Small Cap Value Index Fund from Zacks. Fidelity Advisor Mutual Funds · Fidelity Mutual Funds · Fidelity ETFs · Fidelity Money Market Funds · Model Portfolios · Separately Managed Accounts · The investment seeks capital appreciation. The fund invests primarily in common stocks. It invests at least 80% of assets in securities of companies with small. Fidelity Small Cap Value Index Fund (FISVX) Dividend Info. Fidelity Small Cap Value Index Fund (FISVX) dividend growth in the last 12 months is %. Performance charts for Fidelity Small Cap Value Index Fund (FISVX) including intraday, historical and comparison charts, technical analysis and trend lines. The Fund seeks to provide investment results that correspond to the total return of stocks of small-capitalization U.S. companies. It invests in securities. Get Fidelity Small Cap Value Index Fund (FISVX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Objective. The fund seeks to provide investment results that correspond to the total return of stocks of small-capitalization United States companies. · Strategy.

View the latest Fidelity Small Cap Value Index Fund (FISVX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Fidelity Small Cap Value Index Fund (07/19). FISVX. -. Janus Henderson Small Cap Value Fund Class T (10/87). JSCVX. Fidelity Small Cap Value Index Fund Data delayed at least 15 minutes, as of Aug 09 Use our fund screener to discover other asset types. All securities and identifiers we can link to FIDELITY SMALL CAP VALUE INDEX FUND Close matches include: FIDELITY SMALL CAP VALUE FUND | FIDELITY SMALL CAP. The fund normally invests at least 80% of assets in securities included in the Russell ® Value Index, which is a market capitalization-weighted index. Fidelity Small Cap Value Index Fund advanced mutual fund charts by MarketWatch. View FISVX mutual fund data and compare to other funds. Get the latest Fidelity Small Cap Value Index Fund (FISVX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The Small-Cap Enhanced Index Fund invests about 80% of assets in stocks that make up the Russell Index, but Fidelity aims to beat the index by using. Fidelity Small Cap Value Index Fund (FISVX) ; Fund Assets, B ; Expense Ratio, % ; Min. Investment, $ ; Turnover, % ; Dividend (ttm), Find the latest performance data chart, historical data and news for Fidelity Small Cap Value Index Fund (FISVX) at mailforum.ru Analyze the Fund Fidelity ® Small Cap Value Index Fund having Symbol FISVX for type mutual-funds and perform research on other mutual funds. Analyze the Fund Vanguard Small Cap Value Index Fund Admiral Shares having Symbol VSIAX for type mutual-funds and perform research on other mutual funds. The fund's Retail Class shares returned % in the second quarter of , while the Russell ® Value Index returned %. Longer-term performance. See Fidelity ® Small Cap Value Fund (FCVAX) mutual fund ratings from all the top fund analysts in one place. See Fidelity ® Small Cap Value Fund performance. Analyze the Fund Vanguard Small Cap Value Index Fund Admiral Shares having Symbol VSIAX for type mutual-funds and perform research on other mutual funds. The fund normally invests at least 80% of assets in securities included in the Russell ® Value Index, which is a market capitalization-weighted index. Get the latest Fidelity Small Cap Index Fund (FSSNX) real-time quote, historical performance, charts, and other financial information to help you make more. We're raising the bar on value. Fidelity stock and bond index mutual funds and sector ETFs have lower expenses than all comparable funds at Vanguard Fidelity Small Cap Value Index Fund · Price (USD) · Today's Change / % · 1 Year change+%. Fund Details. Legal Name. Fidelity Small Cap Value Index Fund. Fund Family Name. Fidelity Investments. Inception Date. Jul 22, Shares Outstanding. N/A.